Introduction

The real estate market is undergoing a significant transformation driven by evolving consumer preferences, technological advancements, demographic shifts, and the impact of global events. This article examines the current trends in urban living, with a particular focus on the growing demand for sustainable development, mixed-use spaces, and smart home technology. By understanding these trends, investors, developers, and homeowners can make informed decisions in today’s dynamic real estate landscape.

The Rise of Sustainable Development

Sustainability has emerged as a critical focus in real estate, with urban dwellers increasingly prioritizing environmentally friendly living spaces. This trend aligns with a broader societal shift toward sustainability as individuals and communities become increasingly aware of the impact of climate change and the importance of reducing their carbon footprints.

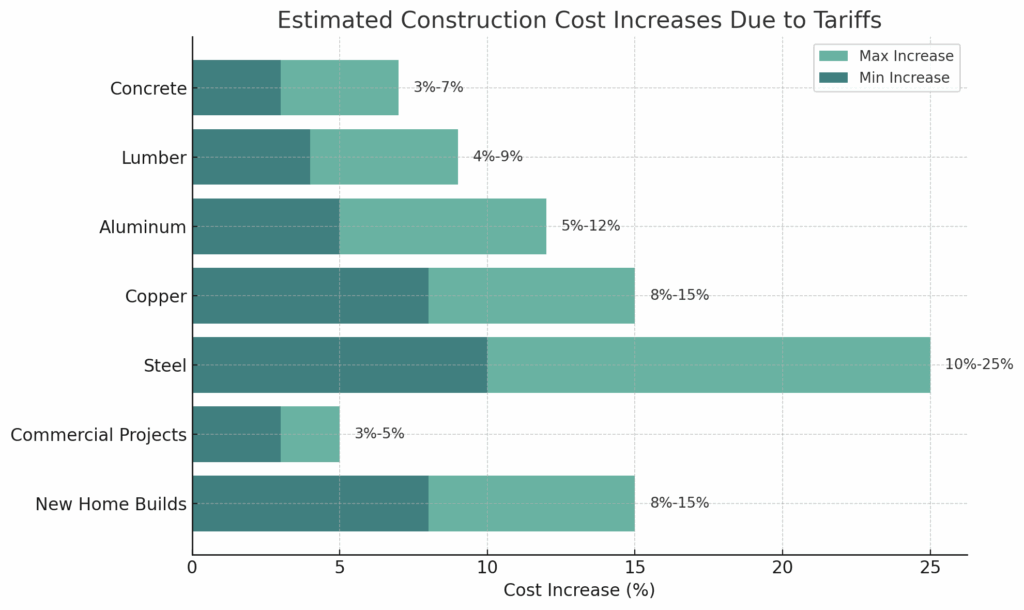

Green Building Practices

The construction industry is responding to this demand by integrating green building practices into new developments. These practices include utilizing eco-friendly materials, optimizing energy efficiency, and implementing renewable energy sources such as solar panels. According to the U.S. Green Building Council, buildings that adhere to sustainable standards can significantly reduce energy and water consumption, resulting in lower operational costs for both homeowners and tenants.

Urban Green Spaces

Moreover, urban planners are increasingly incorporating green spaces into city designs. Parks, green roofs, and community gardens not only enhance aesthetic appeal but also promote mental well-being and community interaction. A study published in the journal “Environmental Science & Technology” indicates that access to green spaces can improve residents’ quality of life, making them a desirable feature in residential developments.

The Popularity of Mixed-Use Developments

Another notable trend in the real estate market is the rise of mixed-use developments. These projects integrate residential, commercial, and recreational spaces into a single area, fostering a sense of community and convenience.

Benefits of Mixed-Use Living

Mixed-use developments cater to the modern consumer’s desire for walkability and accessibility. As urban populations grow, residents increasingly seek neighborhoods where they can live, work, and play without the need for extensive commuting. This trend is particularly evident in metropolitan areas where traffic congestion and long commutes have become significant concerns.

Case Studies: Successful Mixed-Use Projects

Cities such as New York, San Francisco, Miami, and Toronto have seen a surge in mixed-use developments. For instance, the Hudson Yards project in New York City exemplifies how integrating residential, commercial, and public spaces can create a vibrant community hub. Such developments not only attract residents but also enhance local economies by fostering business growth and increasing foot traffic.

The Influence of Smart Home Technology

As technology continues to evolve, smart home innovations are becoming increasingly prevalent in the real estate market. Homebuyers are now looking for properties equipped with smart technologies that enhance convenience, security, and energy efficiency.

Features of Smart Homes

Smart home technology encompasses devices such as smart thermostats, security systems, lighting controls, and home automation systems that can be remotely managed via smartphones. According to a report by the Consumer Technology Association, nearly 75% of U.S. households own at least one smart home device, indicating a growing consumer preference for tech-enhanced living environments.

Implications for Real Estate

For real estate developers, incorporating smart technology into new constructions can significantly increase property value and appeal to tech-savvy buyers. As demand for such features rises, properties equipped with smart technology are likely to command higher prices and attract a broader range of prospective buyers.

Demographic Shifts and Urbanization

Demographic trends, particularly the movement of millennials and Gen Z into urban areas, are reshaping the real estate market. Younger generations prioritize experiences over ownership, leading to increased demand for rental properties and smaller living spaces that offer flexibility and access to urban amenities.

The Impact of Remote Work

The COVID-19 pandemic has accelerated the shift towards remote work, prompting many individuals to reconsider their living arrangements. With the ability to work from anywhere, some are opting for suburban or rural living, seeking larger homes at lower costs. However, urban centers remain attractive due to their rich cultural offerings, diverse job opportunities, and strong social connectivity.

Housing Affordability Challenges

As urban areas continue to experience population growth, housing affordability has become a pressing issue. Many cities are grappling with how to provide affordable housing options while maintaining the character and vibrancy of their neighborhoods. Policymakers and developers are tasked with creating solutions that effectively address both supply and demand.

Conclusion

The real estate market is witnessing a profound evolution shaped by sustainability, technological advancements, and demographic shifts. The trends toward sustainable development, mixed-use living, and smart home technology reflect the changing preferences of urban dwellers, who seek convenience and a high quality of life. As these trends continue to develop, stakeholders in the real estate market must adapt their strategies to meet the demands of a new generation of homeowners and renters, ensuring that urban living remains accessible, attractive, and sustainable.